A collection of financial services designed specifically to meet the unique requirements and smaller scale of Small and Medium-sized Enterprises (SMEs) is known as SME banking.

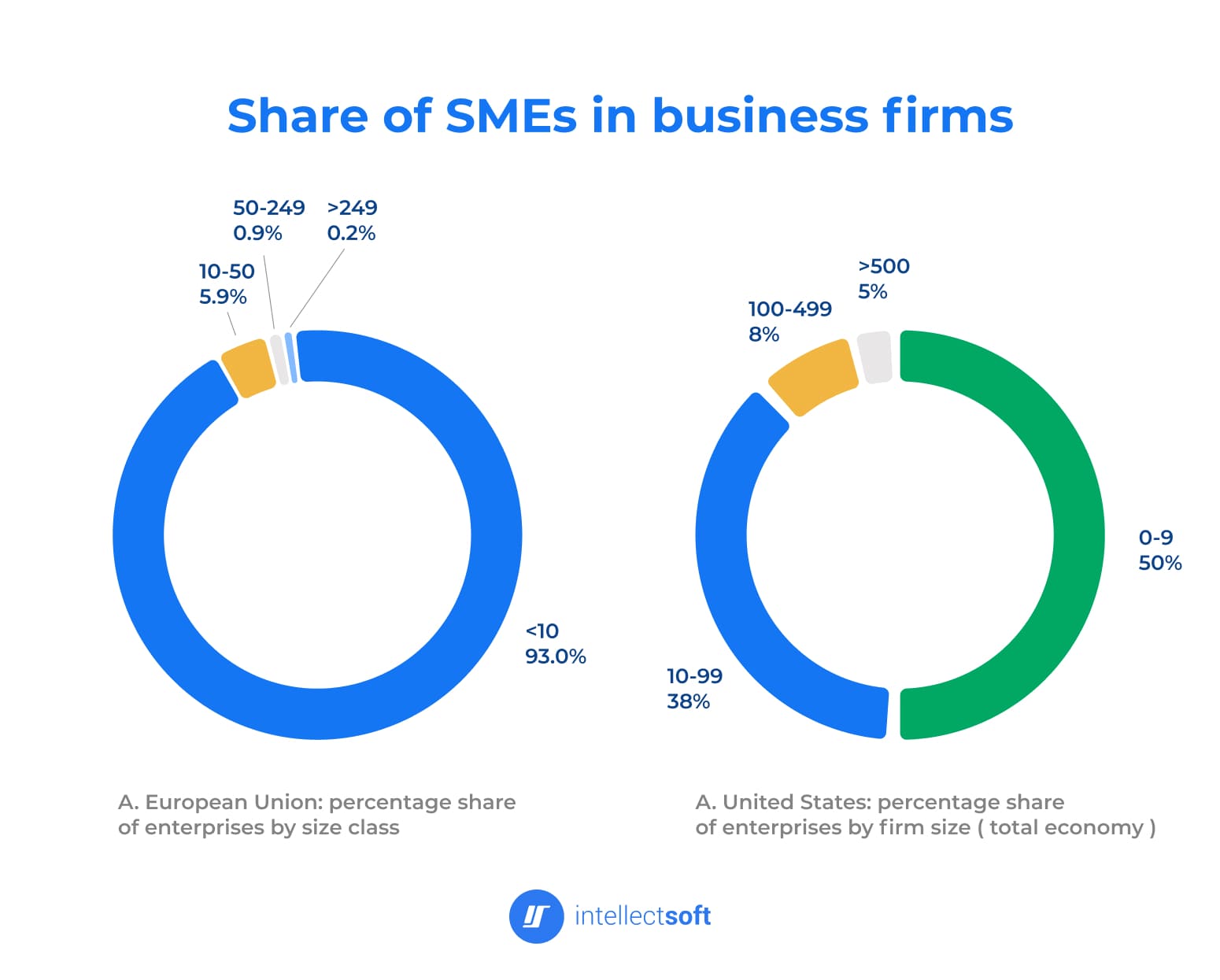

Why is it significant?The OECD estimates that SMEs make up over 95% of businesses and 60%–70% of jobs. They also contribute significantly to the creation of new jobs in OECD nations.

Customized deposit accounts, credit lines, and loans have been progressively redesigned to meet the needs of small and medium-sized enterprises (SMEs) and their work ethic. It wasn’t an easy road, though. Not too long ago, SMEs had to deal with a banking environment that was typically unaccommodating. It was like trying to solve a Rubik’s cube without a blindfold when navigating the typical banking landscape.

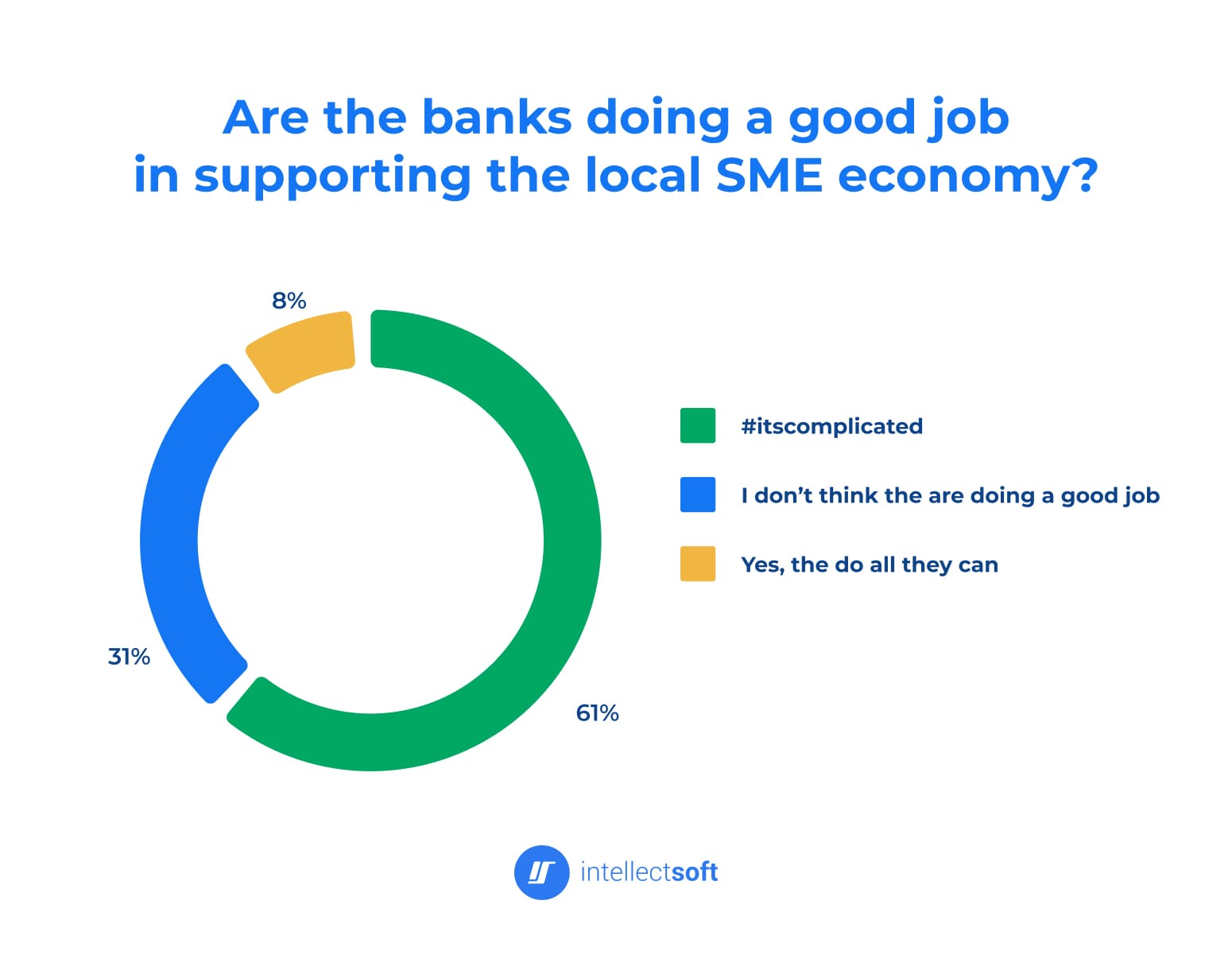

SMEs struggled with exorbitant costs, strict credit evaluations, and optimized one-size-fits-all solutions that, in reality, hardly fit anyone. Getting funding was like climbing Mount Everest, and getting individualized financial counsel was something that only the wealthy and well-connected could afford.

There was a clear discrepancy between what banks provided and what SMEs needed. The FinTech revolution, which promised to remove these obstacles and usher in a new era of personalization, was sparked by this very gap, this misalignment of services.

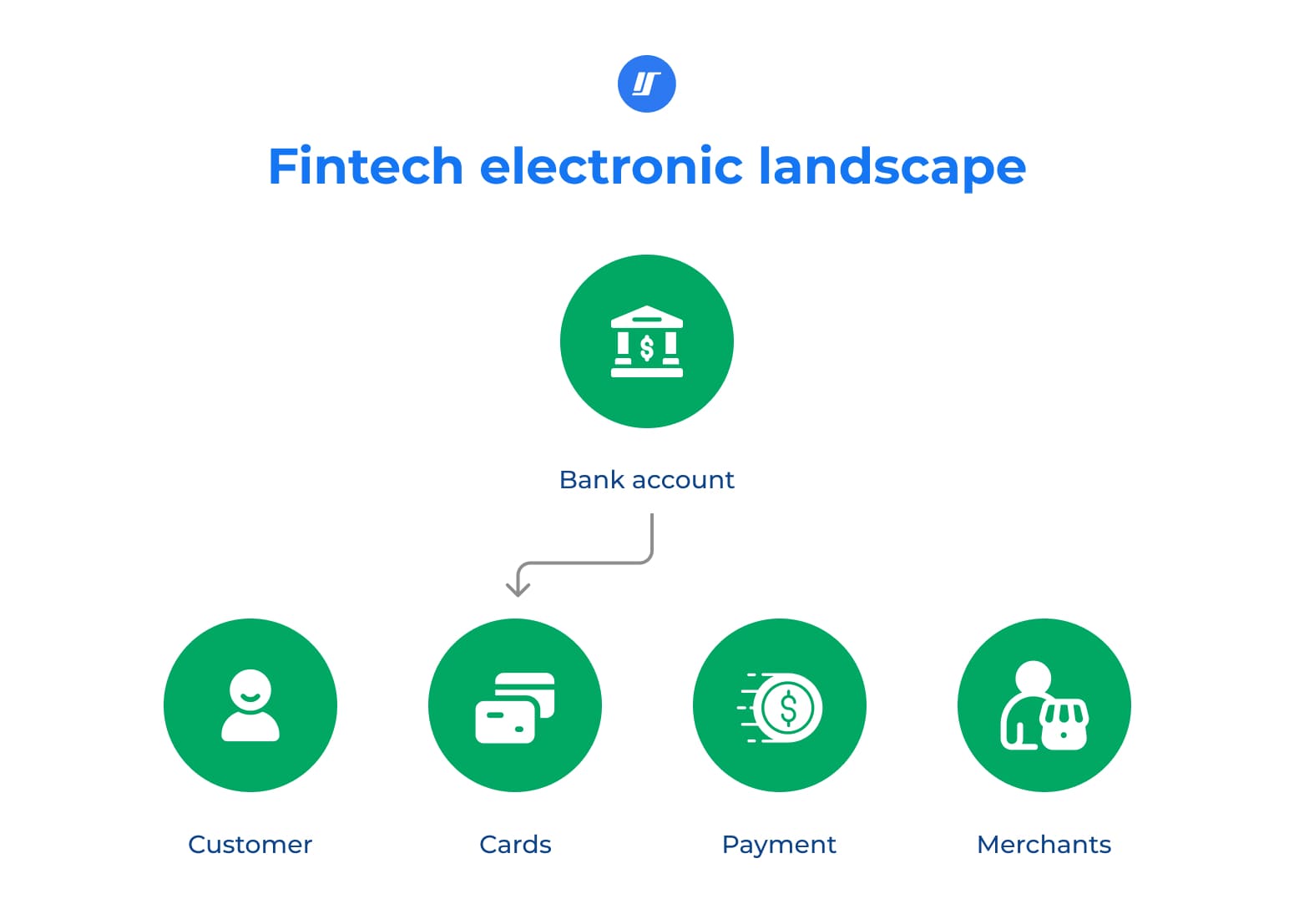

The emergence of FinTech has led to a technologically advanced transformation in the SME banking sector.

Envision a financial world where each product and service is customized, akin to a custom suit that is fitted precisely to fit its wearer. FinTech is enhancing that already exquisite outfit with astute, cutting-edge accessories. Stated differently, SME banking solutions make their financial demands the main attraction rather than merely an afterthought.

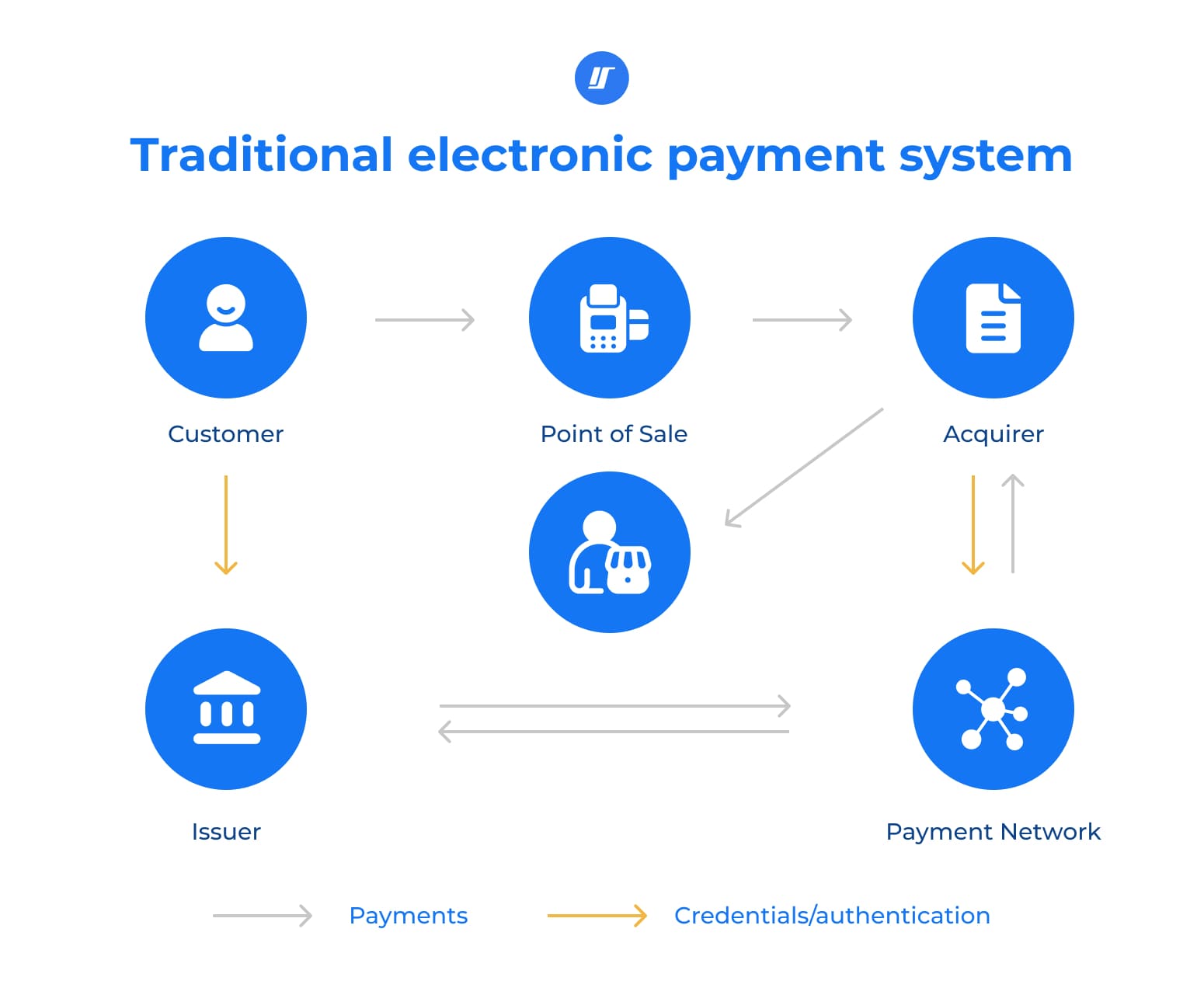

For a more concrete example, consider a small neighborhood bakery that used to spend hours on billing but is now able to handle transactions with ease thanks to a modern digital payment system. FinTech’s incorporation into SME banking is changing the game for the better by enhancing the intelligence and intuitiveness of financial management in addition to its convenience.

FinTech is essentially redesigning SME banking, making it more inclusive, approachable, and in line with the goals and needs of small and medium-sized businesses. It is not merely redefining SME banking.

A SME’s standing in banking is enhanced by FinTech’s creative solution to these problems. It facilitates the businesses’ ability to scale profitably, concentrate on their primary business operations, and function more effectively.

FinTech is the hero here, so to speak. The way small and medium-sized enterprises engage and traverse the financial landscape is revolutionized by SME banking products.

Among their many benefits, digital lending platforms are expediting the loan application process. Weeks’ worth of paperwork can be completed in a few of clicks, much like having a financial expert at your disposal. Consider a modest software business that went from a garage to the world stage thanks to seed money it received via a digital platform. This FinTech toolkit also includes AI-powered financial tools and mobile banking, giving SMEs access to real-time financial data and control.

This is a summary of the most noteworthy FinTech approaches to typical problems.

For SMEs, traditional lending can be a tightrope walk because banks frequently have strict requirements for loan acceptance. FinTech moves to a new beat, providing SMEs with online crowdfunding and peer-to-peer financing platforms that allow them to obtain capital without having to deal with the red tape of traditional banks.

Every dollar matters to SMEs, yet the cost of banking fees can significantly reduce their operating capital. FinTech reduces these expenses with slick, automated procedures, reducing the formerly unmanageable financial drain to a trickle.

For SMEs, juggling payments with antiquated systems can be like negotiating a hedge maze. FinTech makes this maze easier to navigate by providing quick, intuitive payment options that guarantee SMEs maintain a steady inflow of cash.

The field of economic administration is rife with complexities. FinTech provides SMEs with a financial GPS in the form of user-friendly digital solutions that make financial planning and forecasting simple.

SMEs frequently prefer banking that is sensitive to their particular requirements over partially functional, off-the-shelf options. FinTech fits every SME like a glove, providing customized solutions and guidance that complement their unique business strategies.

In the modern business environment, traditional banking hours can be a pain, feeling like a square peg in a round hole in a SME’s calendar. Financial management becomes a flexible procedure that works on any timetable thanks to FinTech’s round-the-clock online platforms and SME mobile banking.

SMEs may be unjustly branded by conventional credit scores, which could leave them without access to credit. In order to present a more accurate picture of a SME in banking, FinTech employs a wider lens that takes into account a variety of data sources, highlighting the SME’s creditworthiness and introducing them to additional funding alternatives.

SMEs risk getting lost while navigating the financial landscape without a map. FinTech helps SMEs achieve better financial health by offering this map through easily available and understandable educational resources.

Data leaks are like opening doors for SMEs in the digital age. FinTech keeps the financial data of SMEs dry by reinforcing the dam with cutting-edge security measures like blockchain and encryption.

For SMEs, adhering to rules can feel like a tightrope act. Without requiring a circus act, FinTech serves as a safety net by integrating compliance elements that assist SMEs in adhering to financial laws and norms.

Due of the complexity of currency exchange and cross-border payments, global business can get SMEs tangled up. FinTech untangles these tangles by providing simplified solutions for cross-border transactions, transforming a complex international issue into a piece of cake.

SMEs’ cash flow might be severely hampered by late payments. FinTech provides a lifeline by providing services like digital invoicing and invoice finance, which guarantee payments run as smoothly as a peaceful river and support the financial stability of SMEs.

FinTech tackles the unique problems faced by SME banks with these creative solutions, enabling businesses to successfully and more easily traverse the financial landscape.

The story of banks and FinTech startups is one of partnership and cooperation, with each player contributing their own capabilities. This synergistic union relies on combining technological innovation with the dependability of traditional banking procedures.

The FinTech titans themselves may be the best examples among the many case studies available here. Taavet Hinrikus, a former employee of Skype, co-founded TransferWise, a prime example of FinTech innovation for SME needs. An SME that began as a personal need to avoid expensive cross-border transaction costs has developed into a major participant in the market, providing effective, affordable international payment solutions that are now extensively utilized by other SMEs.

The success stories of Revolut and Lending Club further highlight the successful blending of traditional financial services with tech-driven solutions to meet the needs of small and medium-sized businesses (SMEs) globally.

Small and medium-sized businesses are constantly monitoring FinTech advancements as they open up new growth options, which is transforming the business landscape for them. Algorithms are used by digital lending companies to evaluate creditworthiness, offering quicker and easier access to finance alternatives. This is especially advantageous for companies that were previously disregarded by traditional banks. Furthermore, customized banking services offer a degree of customization and a range of integration options that were previously unaffordable for many.

Example: Because of the nature of its operation, a boutique coffee shop with a great potential may find it difficult to obtain typical bank loans.

Furthermore, SME banking is being revolutionized by AI and data analytics, which are turning guesswork into strategic decision-making. SMEs can improve their inventory management and marketing strategy by using these tools for cash flow forecasting and customer spending research. “SMEs can now look at historical data and make projections for what may happen in the years ahead thanks to the advent of predictive analytics tools such as machine learning algorithms or modeling software,” Wealth & Finance states.

Example: With tailored solutions from a single FinTech platform, small construction enterprises may now simplify their financial operations.

FinTech is also making it easier for SMEs to enter foreign markets. Once hampered by intricate banking procedures, simple, effective processing of foreign payments and currency risk management opens up worldwide potential. Based on data from listed small and medium-sized businesses from 2011 to 2020, a study by Chinese specialists demonstrated how FinTech in banking might greatly reduce the financing constraints faced by SMEs. According to their findings, there was a 0.0767% drop for every 1% growth in fintech.

FinTech innovation is a bright future for SME banking, and one doesn’t need a crystal ball to see it. Day by day, technologies like open banking, blockchain, and artificial intelligence (AI) advance, promising to further transform this field.

SMEs have already started utilizing blockchain for safe, transparent transactions in addition to AI assistants to help them manage their money. This future is not only a potential; it is materializing right before our eyes, transforming the banking industry as a whole into a vibrant, technologically advanced ecosystem.

In conclusion, there are more than just advantages to the union of FinTech and SME banking—it is revolutionary. SMEs are now active participants in the banking industry rather than passive observers, and it’s an endeavor of overcoming obstacles and capturing chances. There’s no denying that FinTech is changing the financial landscape for SMEs.

With their customized FinTech solutions, businesses such as Intellectsoft become important actors in such an inspirational environment. They leverage their extensive worldwide experience to support the expansion of SMEs by offering customized financial technology platforms that are accessible, useful, and inventive.

Because of Intellectsoft’s dedication to providing excellent services, SMEs may confidently and effectively traverse the complexity of the global market thanks to its software’s seamless integration into their operations.

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 | 31 | ||

We are a team of artists. We provide professional services in the field of Mobile Applications, Web Applications and everything related to IT services. Turning to us for help once – you can no longer refuse.

© 2019 – 2022 | Made with ❤️ by App Ringer

Recent Comments